Looking at today's action in Silver, I was shocked. The day started normally enough, with a powerful bullish market that took Silver all the way up to $23.36 by 19.50 GMT. It then began a slow decline to $22.87. However, it is what came after that made me gape with amazement. A massive volume spike at exactly 22.14 started an incredible series of data the likes of which I have never seen before. While the price remained absolutely flat at a top of 22.86 the price was taken down to 22.82 _9 times_. During this anomaly that lasted exactly one hour, from 22.00 to 23.00, the ask price remained mostly at 22.9, spiking at 22.97, a spread of an incredible 15c!! or 0.6%

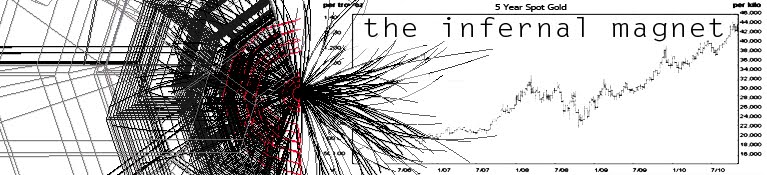

I have _never_ seen spreads this wide before and the exact timing of this phenomena, as well as the price gapping just after 22.00 leads me to believe this was computer generated event. It almost looks, from the data, as though an algo made the market dance to it's whim. Notice the gapping in price from 21.45 and then the steady rise in volume from starting at exactly 22.00. The volume keeps rising, until 22.14, when the volume peaks and BAM, for the next 45 minutes, the market behaves in a totally unchaotic manner with the largest bid/ask spreads I have ever seen. In my opinion, someone made a killing off this event and if it is the first example of some new kind of technology, then I fear for market stability more now than ever. I hope Nanex will get in on this and provide some micro data from the series. Until then, this 1min chart is the best I can do. Note that nothing like this happened on the Gold market, perhaps because the Gold market is much larger and therefore harder to manipulate.

If anyone has any information on this event, please contact me through the Bullion Traders Facebook group.

No comments:

Post a Comment